Knowing how to manage your finances correctly is essential when it comes to staying out of financial difficulty and finding online loans. Spending too much in unnecessary areas and struggling to pay off debt can have an impact on your cash flow, and if you’re faced with an emergency, it could be detrimental. A payday loan can help if you’re desperate and cannot pay for an unprecedented expense – but there are steps you can take to combat financial trouble. Read on to find out more.

Get to Know Your Finances

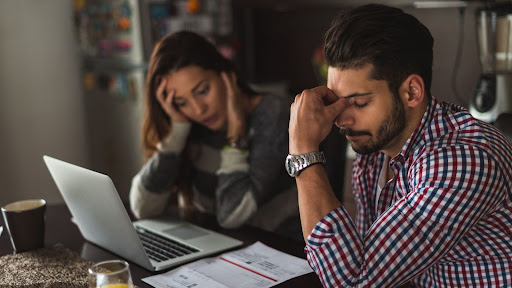

The best place to start when it comes to combating financial issues is to get to know what’s causing the issue in the first place. Look at your monthly income and compare it to your outgoings – is there something that you are spending a lot of money on that you could do without? Maybe you’ve racked up a credit card bill, or you’re paying off a loan.

Taking a look at your finances and getting to know what is going wrong and why is the best way to combat your money troubles. If you know you’re struggling with money, looking at your bank balance and statements may be the last thing on your mind – it’s easier to bury your head in the sand. But if you do this, you’re not going to be able to progress. Knowing what you have coming in and going out each month is the best way to proceed with making a change.

Make a Budget

Creating a budget means you’re able to manage your money easily and for the better. Look at your income each month and subtract your primary outgoings – this is anything from your mortgage or rent payments, car payments – anything you need to live. The money that you have left over is what you use for secondary expenses. You should also make sure you include savings in your budget so that you can remain consistent and build up a pot of savings in case of emergencies. If you don’t have a lot of money left over after you’ve covered your bills, it might be time to cut back.

Cut Back

Creating a budget helps with this but having an in-depth knowledge of your outgoings helps too. Many of us will be guilty of forgetting to cancel subscriptions and memberships because we rarely take the time to review our bank statements. If you have a membership that you don’t use – for example, the gym membership you pay for each month that you stopped going to, cancel it. If you find that you’re spending a lot of extra cash in areas that aren’t necessary, like buying your lunch every day, start making a packed lunch so that you can save a lump sum each week – you’ll be surprised at the difference it makes.

Avoid Using Credit Cards

Although credit cards give us access to additional funds when we need them, they can cause issues when it comes to our finances. It can sometimes be tempting to use credit cards to help you make a large purchase or to dip into the additional funds when you’re struggling, but you have to remember that you’ll need to pay the debt back. Credit card debt is common for a lot of people, and if money is tight to start with, added credit card bills are going to make it harder. Try and limit your use of credit cards to avoid getting further into debt.

Increase Income

This may seem obvious, but increasing your monthly income can help you combat financial issues. And it doesn’t have to be difficult! There are some obvious ways you could do this, like asking to progress in your current job to earn more money or looking for another job with a higher salary. If you don’t want to change jobs, you could have a clear-out and sell second-hand items of clothing online or make money from your favorite hobby – like photography or beauty, or even become a blogger.