- Borrowing can be simplified by understanding the process, preparing necessary documents, and choosing lenders with user-friendly systems.

- Technology, like online lending platforms and AI-driven tools, has made loan applications faster, more efficient, and convenient.

- Key factors like interest rates, repayment terms, and hidden fees should be carefully reviewed to make informed borrowing decisions.

- Building financial confidence through budgeting tools, financial literacy, and professional guidance ensures a responsible and empowered borrowing experience.

Let’s face it—borrowing money can feel like a maze. The endless paperwork, financial jargon, and uncertain outcomes often leave people frustrated before they even begin. But here’s the truth: it doesn’t have to be this way. Borrowing can be straightforward, manageable, and even empowering if you approach it the right way.

In this blog, you’ll learn how to navigate personal loans with ease, from understanding the common pitfalls to adopting practical strategies that simplify the entire process. By the end, you’ll have the knowledge and confidence to take control of your borrowing journey. Ready to discover how borrowing can be simple? Let’s dive in.

Why Borrowing Often Feels Complicated

Borrowing isn’t just about getting approved for a loan—it’s a process filled with hurdles. One of the biggest challenges is understanding the terminology. Words like “amortization,” “variable APR,” and “prepayment penalties” can leave even the savviest borrower scratching their head.

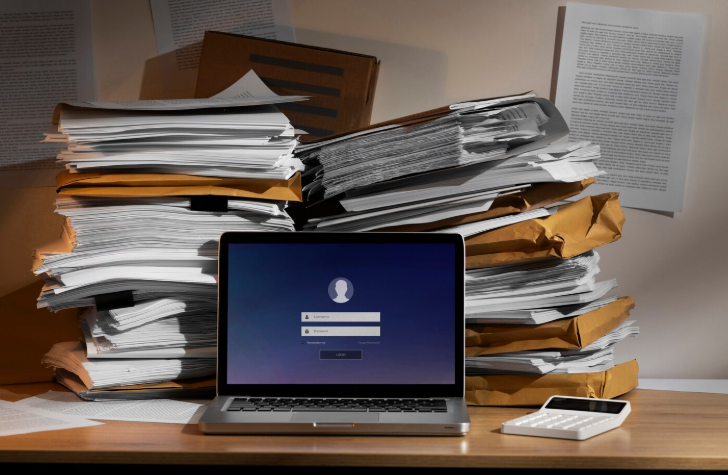

Then, there’s the sheer amount of paperwork. Traditional loan applications often require a laundry list of documents, from pay stubs to tax returns, turning what should be a straightforward process into a logistical nightmare.

On top of that, the fear of rejection looms large. Many people avoid borrowing entirely because they’re overwhelmed by uncertainty, not knowing if their credit score, income, or history will measure up.

The good news? These obstacles are solvable. With some preparation and a clear understanding of the process, borrowing can go from stressful to seamless.

Tips for Making Personal Loans Simple

Simplifying personal loans starts with preparation. Before you even begin an application, take the time to gather your financial information. This includes your credit score, proof of income, and a list of monthly expenses. Having these details at your fingertips can save time and reduce stress.

Another key step is to compare lenders. Not all lenders are created equal, and choosing one that offers straightforward terms can make all the difference. Look for transparent policies, no hidden fees, and responsive customer service.

Finally, streamline the application process by choosing lenders with user-friendly systems. Many modern lenders offer online tools that make it easy to apply, track your application, and even sign documents electronically. These platforms are designed to eliminate unnecessary steps, allowing you to focus on what matters most: securing the funds you need.

By following these tips and keeping an eye out for an easy application for personal loans, you’ll find that borrowing doesn’t have to be a headache. It’s all about preparation, comparison, and choosing lenders who prioritize simplicity.

How Technology is Revolutionizing Loan Applications

Gone are the days when applying for a loan meant endless trips to the bank, stacks of paperwork, and weeks of waiting for approval. Thanks to technology, the loan process is now faster, more efficient, and accessible to nearly everyone.

One of the biggest innovations is online lending platforms. These platforms allow borrowers to complete the entire process from the comfort of their homes. From submitting applications to verifying documents and even signing agreements, everything can be done digitally. This not only saves time but also eliminates much of the stress traditionally associated with borrowing.

Artificial intelligence (AI) is another game-changer. Lenders are using AI-driven tools to assess applications quickly and accurately, often providing pre-approvals in minutes. AI also enables personalized recommendations, helping borrowers find loans that best suit their financial situations.

Additionally, mobile apps have made loan management easier than ever. Borrowers can track payments, view loan details, and even adjust repayment schedules with just a few taps on their smartphones. These tools empower borrowers to stay in control of their loans without the need for constant communication with the lender.

By embracing these technological advancements, you can make borrowing not only simple but also surprisingly convenient. It’s all about choosing lenders who leverage these tools to enhance the borrower’s experience.

Key Things to Know Before Borrowing

While simplifying the loan process is important, understanding the finer details of borrowing is equally crucial. A lack of awareness can lead to costly mistakes, so let’s break down the essentials.

Start by familiarizing yourself with interest rates. Fixed rates remain constant over the life of the loan, while variable rates can fluctuate. Understanding the difference ensures you pick a loan that aligns with your financial stability.

Repayment terms are another critical factor. Shorter terms might come with higher monthly payments but lower overall costs, while longer terms provide smaller payments but often accrue more interest. Knowing what you can comfortably afford each month will help you decide the best option.

Lastly, be on the lookout for hidden fees. Some lenders charge application fees, origination fees, or even penalties for paying off your loan early. Carefully reviewing the terms and conditions can save you from unexpected expenses down the line.

Taking the time to educate yourself on these factors ensures that borrowing is not just simple but also a smart financial decision. Being informed sets the foundation for a positive borrowing experience.

Building Financial Confidence for Your Loan Journey

Borrowing can feel intimidating, but building your financial confidence can make the process much more manageable. Start by improving your financial literacy. Understanding basic concepts like credit scores, debt-to-income ratios, and how interest works can empower you to make informed decisions.

Budgeting tools are a fantastic way to gain clarity on your financial situation. Apps like Mint or YNAB (You Need A Budget) help you track income, expenses, and savings goals. Knowing exactly where your money is going can give you the confidence to borrow responsibly.

If you’re unsure about loan terms or repayment plans, don’t hesitate to seek professional guidance. Financial advisors or credit counselors can provide personalized advice tailored to your circumstances. They can help you evaluate offers, compare rates, and even negotiate terms if needed.

Remember, confidence comes from preparation. When you’re informed and organized, borrowing becomes less about fear and more about achieving your goals with assurance and ease.

Conclusion

Borrowing doesn’t have to be a stressful ordeal. By understanding the challenges, embracing modern tools, and preparing yourself with knowledge, you can turn the process into an empowering experience.

With the right strategies and a focus on simplicity, navigating personal loans becomes a task you can tackle confidently. Approach your borrowing journey with the preparation and mindset outlined here, and you’ll be well on your way to securing the funds you need—stress-free.